Bacteria invest in motility

When food is scarce, bacteria can tap new resources

In biological, but also financial systems, regulatory strategies reflect an inherent trade-off between costs and benefits of resource investment. In the case of the bacterium Escherichia coli, the costly investment in motility is increased when food is scarce. According to scientists bacteria appear to pre-invest into motile behavior – a trade-off that is ultimately dependent on the abundance and quality of the encountered nutrients.

Like humans, bacteria in most ecosystems live with limited resources. Therefore they are constantly faced with investment decisions: should they enhance motile behavior and thus be able to exploit new resources, or give priority to cellular growth, thus gaining a reproductive fitness advantage?

Swimming bacteria typically can follow various nutrient gradients in their environment by modulating the frequency of cell reorientations relative to the nutrient gradient (chemotaxis). Bacterial swimming is based on rotating flagellar filaments powered by the proton motive force. A complex chemotaxis signaling pathway including a number of stimulus-specific receptors controls both chemotaxis and motility. Thus swimming motility is one of the costliest bacterial behaviors. Instead of paying in cash, microorganisms trade in costly proteins. The processes involved in chemotaxis and motility consume several percent of the total cellular protein and energy budget, which is primarily spent on building flagella and powering their rotation respectively, and to a lesser extent on chemotactic signaling.

`Eat and run`

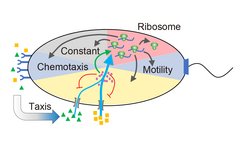

Growth-rate dependent partitioning of the cellular protein budget into different functional sectors in E.coli. 2 different nutrients, (indicated by triangles and squares) are co-utilized, which is regulated by cAMP (small circles). Also indicated is the chemotaxis-mediated enhancement of nutrient uptake.

“Because of the high costs of motility, the expression of flagellar genes significantly reduces growth”, says Bin Ni, post-doctoral researcher in Victor Sourjik’s ‘Microbial Networks’ group at the Max Planck Institute for Terrestrial Microbiology in Marburg. “But surprisingly, E. coli up-regulates motility especially when food is limited. This poses the question of the inherent trade-off between the benefit and cost of this resource investment, which is linked to the more fundamental question: to which extent are gene regulatory programs optimized by evolution?”

In a collaboration with Imperial College London, the Max Planck researchers were able to show that the benefit provided to motile bacteria by their ability to follow gradients of nutrients increases at slow growth in the same way as the investment in motility.

Bacterial investment can be anticipatory

Thus, bacteria appear to pre-invest into the motile behavior in proportion to the anticipated benefit that can be provided by chemotaxis when nutrient gradients become available in their environment. Such predictive investment of cellular resources might have emerged because nutrient gradients in the natural environments of bacteria, be it animal gut or soil, are unpredictable and short-lived. As a consequence, bacteria might not be able to reliably couple the expression of motility genes to the benefit provided by chemotaxis.

What could a Wall Street manager possibly learn from bacteria? “As the animal gut is no trading floor, we should treat the parallels to financial markets with caution,” Victor Sourjik remarks. “But increasing investment in proportion to anticipated future payoffs, even as resources get scarce, might work well for both biological systems and financial markets. At least for bacteria exposed to uncertain environments, this seems to be an optimal strategy.”