The inequality in pension payments over the life course

Inequalities in lifespans are the main driver of inequality in lifetime pensions

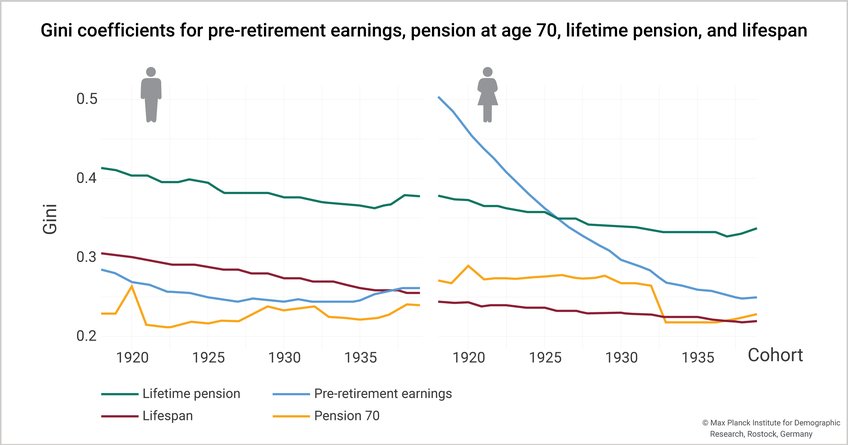

In modern societies, there is great inequality in the amount of pension that men and women receive over the course of their lives. This inequality is a consequence of both the fact that some people live long lives and the fact that the amount of pension people receive varies widely. Although this inequality is larger than inequalities in wages, for example, it is rarely studied. No previous research has examined how large inequalities are when looking at total lifetime pensions, the sum of pension payments over a lifetime. In a recent paper, Jiaxin Shi from Max Planck Institute for Demographic Research and Martin Kolk from Stockholm University examined these inequalities in lifetime pensions in Sweden. Inequalities in mortality and life expectancy play an important role.

For the study, the researchers analyzed data on people born in Sweden between 1918 and 1939. They used data up to 2018 from Swedish administrative registers, including all pension payments derived from Swedish tax records. They measured lifetime pensions as the cumulative pensions from all parts of the Swedish pension system from age 65 until death.

Shi and Kolk's study finds that lifetime pensions are more unequally distributed than pre-retirement income and annual pension income. "Inequality in lifetime pensions is mainly related to inequality in life expectancy and, to a lesser extent, to inequality in pre-retirement income," Shi said. In addition, the researchers observe a trend across the birth cohorts observed that "the inequality in lifetime pensions is decreasing in more recent cohorts. One of the main reasons is that men and women are living longer and reaching older ages more consistently. But for women, the increase in their labor force participation has also been an important contributor to the decline in lifetime pension inequality."

Impact of pension policy

The research also finds that the impact of pension policy on lifetime pensions tends to be relatively small, unless it affects the number of pension years. The overall increase in the statutory retirement age is found to be associated with an increase in lifetime pension inequality. "The main driver of inequality in lifetime pensions is differences in life span. People with higher levels of education and previous earnings not only receive annual pensions, but also have longer life expectancies and have accumulated more years of pension payments. Thus, inequality in lifetime pensions is due to an unequal distribution of preretirement socioeconomic factors. In addition, mortality differences due to other factors-such as genes and neighborhood, which are difficult to quantify and were not included in this study-are also important reasons why we observe large inequalities in lifetime pensions," says Shi.

Two key factors affect lifetime pensions: past earnings from work and the associated pension contributions, and a person's life expectancy. "Studying the distribution of lifetime pensions not only helps to understand how pension systems work, but also opens up additional perspectives on inequality in old age. It provides a new way of looking at social stratification in general," says Jiaxin Shi. "The social advantage or disadvantage at younger ages persists in later life, combined with inequalities in life expectancy. Longer life expectancy and higher lifetime pensions are concentrated among individuals with higher socioeconomic status, who tend to accumulate more pensions and thus are likely to bequeath more to their children. Pension inequalities may therefore be one of the mechanisms by which inequality persists across generations," he said.